Celebrities

Artificial Intelligence can (AI) revolutionize the world of finance and potentially make individuals wealthier

As businesses accelerate their AI initiatives, it raises the question of whether human financial advisors will become obsolete in the coming years, with computers offering faster and more cost-effective alternatives.

To evaluate the likelihood of this scenario, Dailymail.com turned to ChatGPT for answers to four fundamental investment-related questions and sought insights from financial experts to analyze the results.

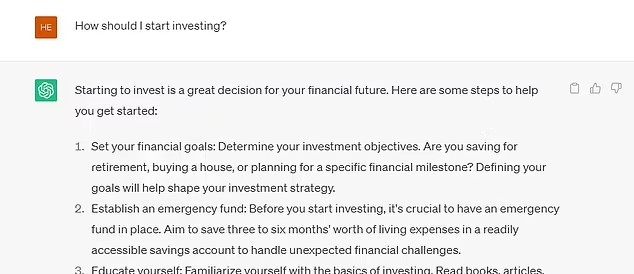

Question: How do I start investing?

ChatGPT responded with a comprehensive 538-word answer, providing 11 steps for beginners to consider. The steps included setting financial goals, establishing an emergency fund, educating oneself, determining risk tolerance, starting with a retirement account, opening a brokerage account, determining asset allocation, investing in low-cost index funds or ETFs, monitoring and rebalancing the portfolio, and staying informed and adaptable. Notably, ChatGPT's response included disclaimers urging readers to consult with a financial advisor for personalized advice tailored to their specific circumstances.

Experts' views:

Wealth manager Eric Mangold, based in New York, commended ChatGPT's advice as broad-based and suitable for self-directed beginners. He emphasized the importance of education and understanding risk tolerance. However, financial planner Marissa Reale noted that the advice lacked personalization, suggesting that seeking personalized advice is crucial in personal finance. She highlighted the need to consider individual factors such as high-interest debts and the client's specific circumstances when establishing an emergency fund.

Question: Should I invest in stock Nordisk?

ChatGPT's response began with a strong disclaimer, clarifying that it cannot provide personalized financial advice or specific investment recommendations. It then outlined seven general steps for considering investments, including researching the company, assessing industry and market conditions, analyzing financial indicators, considering valuation, understanding risks, diversification, and seeking professional advice.

Experts' views:

Anthony Martin, CEO of insurance firm Choice Mutual, cautioned against expecting specific investment advice from ChatGPT due to the lack of transparency in how the model processes data. He highlighted the potential bias and inaccuracies that could arise from relying on ChatGPT for investment decisions. However, Mangold praised ChatGPT's guidance, acknowledging its value in providing a structured approach and understanding risks.

Latest News

As businesses accelerate their AI initiatives, it raises the question of whether human financial advisors will become obsolete in the coming years, with computers offering faster and more cost-effective alternatives.

To evaluate the likelihood of this scenario, Dailymail.com turned to ChatGPT for answers to four fundamental investment-related questions and sought insights from financial experts to analyze the results.

Question: How do I start investing?

ChatGPT responded with a comprehensive 538-word answer, providing 11 steps for beginners to consider. The steps included setting financial goals, establishing an emergency fund, educating oneself, determining risk tolerance, starting with a retirement account, opening a brokerage account, determining asset allocation, investing in low-cost index funds or ETFs, monitoring and rebalancing the portfolio, and staying informed and adaptable. Notably, ChatGPT's response included disclaimers urging readers to consult with a financial advisor for personalized advice tailored to their specific circumstances.

Experts' views:

Wealth manager Eric Mangold, based in New York, commended ChatGPT's advice as broad-based and suitable for self-directed beginners. He emphasized the importance of education and understanding risk tolerance. However, financial planner Marissa Reale noted that the advice lacked personalization, suggesting that seeking personalized advice is crucial in personal finance. She highlighted the need to consider individual factors such as high-interest debts and the client's specific circumstances when establishing an emergency fund.

Question: Should I invest in stock Nordisk?

ChatGPT's response began with a strong disclaimer, clarifying that it cannot provide personalized financial advice or specific investment recommendations. It then outlined seven general steps for considering investments, including researching the company, assessing industry and market conditions, analyzing financial indicators, considering valuation, understanding risks, diversification, and seeking professional advice.

Experts' views:

Anthony Martin, CEO of insurance firm Choice Mutual, cautioned against expecting specific investment advice from ChatGPT due to the lack of transparency in how the model processes data. He highlighted the potential bias and inaccuracies that could arise from relying on ChatGPT for investment decisions. However, Mangold praised ChatGPT's guidance, acknowledging its value in providing a structured approach and understanding risks.

Jennifer Lopez looks ageless in a towel in no-makeup video

Amanda Holden spanks her derriere and thanks Spanx

Amanda Holden shows off more than bargained as she dances around in her outfit of the day

Meet Harley Cameron, the stunning model who went from a BKFC ring girl to become a pro wrestler and found love

GreenGirlBella, Rocks Emirates Stadium in Painted Home Kit

Amanda Holden calls herself a 'good girl' in white dress with 'cheeky' split

Mum slammed by parents after flashing thong in school run outfit

Lottie Moss makes jaws dropp as she shows off her flawless body

Amanda Holden wears nothing beneath plunging white dress

Comments

Written news comments are in no way https://www.showbizglow.com it does not reflect the opinions and thoughts of. Comments are binding on the person who wrote them.